Friends,

(Quick Note: I’m on vacation next week so you can expect the next Moontower on March 15th.This one is a touch longer.)

This past Wednesday, a NYT oped wrote:

..But after watching the stock market plummet on Monday and governments struggling to get hold of the contagion, I’ve begun to smell doom.

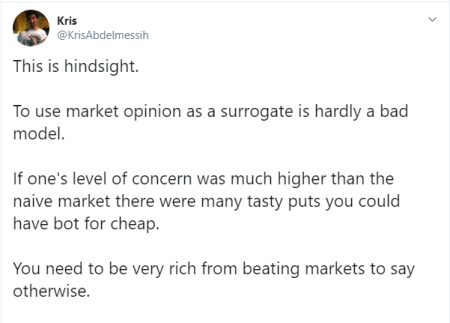

A response to this quote on Twitter:

“Hilarious. He only needs reactions of others to react, not basic facts.”

What do you think of that Twitter response? Is the oped author guilty of herd thought?

Let’s take a detour first, I promise it will re-connect in the end.

What Are Markets

There are various ways humans self-organize. Home life is an autocracy. Parents wield absolute power. If the kids get to vote on what’s for dinner it’s because the elders signed off on a temporary puppet democracy. In broader civilization, there are networks and governments. Plutocracy, theocracy, monarchy, parliament, communism, fiefdoms, tribes, democracy. No matter which backdrop they must operate in, one of humanity’s most clever constructs was the marketplace.

Through trade and barter, markets focus a multiplicity of needs, desires, and trade-offs into prices. Prices allocate resources. High prices attract supply and ration demand. A consistent ability to shrewdly respond to prices either as a company, investor, or consumer leads to profit. The potential and motive to profit certify prices as honest signals.

The Dinosaur Question

Democracies are controlled by votes. All votes are equal. But, markets are not democracies. To understand the difference I’ll recount a lesson I was taught as a trader trainee 20 years ago.

It was explained:

If you poll the population, “Did humans walk the earth at the same time as dinosaurs?”, the responses come back split about 50/50. That’s democracy.

Now imagine there is a contract that trades openly on an exchange that is worth $100 if it is true that dinosaurs and humans co-existed and $0 if that is false. Even though the population is split, this contract is not going to trade for $50. It’s going to zero. Why? Because the small percentage of people and scientists who know the truth are going to see a profit from selling this contract even down to $1 since they know this proposition is false. And if the scientists don’t have enough money, they will be able to convince or get hired by people with more money to back this venture of selling this contract to zero.

That is the value of markets. You get correct answers. While a democratic poll may tell you what people believe or desire, it does not assign the proper truth value to the proposition. Now consider the implications of being correct. You make more money which gives you more resources to continue being more correct. The marginal price in markets is set by the market participants with the most money and as a group, they have the best-calibrated assessment of what fair value is. And these groups are in the minority of the total betting population. Markets are not a democracy. To dismiss prices is an impressive act of arrogance.

An Aside For Finance Folks

You may recognize traces of strong-form efficient market hypothesis in this view. It is fashionable to point to market failures and bias which can distort the truth value of prices in our economy. Markets are nested within laws that are nested within our democracy. There are many joints in the structure subject to friction or even corruption which dilute the purity of markets. But for a market to be efficient doesn’t mean its truth value is decreed by the all-knowing. The standard to be efficient is simply to what extent you can earn an excess risk-adjusted profit betting against it. Well, by that standard market prices have a sterling track record revealing most players to be nothing but tourists. It could be wrong, but that doesn’t mean you can do better.

When Prices Seem Irrational

The correct reaction to strange prices is not to say “that’s stupid”. It’s “why is somebody paying that?” Prices are amazing discovery tools to explore “why”. When Vancouver condos are trading at egregious multiples over local wages, rather than presume the buyers were suckers, you may have discovered that Chinese nationals were restricted in how much Yuan they could expatriate. Real estate is a convenient store of value, not just shelter. While it’s not as stable as a savings account, the price of real estate as a safe haven for cash is not being set at the margin by someone like you. It’s set by a family across the world who finds its local savings account a bit too close to its government’s paws. The extra volatility is seen as nothing more than a convenience fee.

Ok, back to the tweet:

“Hilarious. He only needs reactions of others to react, not basic facts.”

Record scratch. Stop right there, freethinker.

When AAPL releases earnings, you don’t read the 10Q unless that’s your job. You look at the price after-hours to see how the market understood it. When a star player is placed on an injury report you look at the game line to see if the odds changed. These are correct reflexes for good reasons.

When you hear people lament that market prices in response to COVID-19 are being set by traders who know nothing about virology instead of doctors, pause for a moment. Are the sharps who set betting lines doctors capable of handicapping recovery times of turf toe or patellar tendons? Of course not. Their expertise is in looking at past data, pattern-matching, and propagating newly calibrated parameters through proven models to generate bets. A sharp’s long-term track record is a self-evident testimonial.

The best investors are information-synthesizing odds setters. This is being done across decentralized domains. The option guys are betting on volatility surfaces, the macro gals are thinking about growth rates and international money flows, while the fundamental folks are thinking about how many people are going to be watching Netflix, buying Purell, and working remote. VCs are Slacking their biotech founders while reporting back to their investors on calls. Those same investors close the loop back to the hedge fund managers who look up from their own war room analysis. The emergent consensus from all this hive activity is in fact what finance is. A networked machine optimized for pricing future states of the world. This optimization likely includes being networked to medical intelligence through its fastest pathways. The fact that it’s not all medical professional pathways should not offend. Instead, it speaks to how efficient this architecture is.

They say when you write to imagine who you are writing to. I feel like I just wrote to that person who has a market take based on what his rheumatologist uncle told him about viral infections. I’ll take my chances that the smartest people setting prices have access to the smartest minds in epidemiology.

The topic of market efficiency, the validity of prediction markets, and the wisdom of crowds would take several scholarly lifetimes to sift through. Who has time for that? I’ll just give you the tl;dr based on my professional experience.

- Markets are very smart. If you cannot make sense of what they are doing most of the time you are missing something. I could fill a blooper reel of me getting served this lesson.

- In the cases when you seemed to outsmart the market you are not actually on solid ground. You have probably just found seen an oasis in an epistemological desert.

- Give prices their due. Understand your basis for mistrusting them when you do and see if you can test the supports for that basis with data as it emerges.

- Finally, do not feel bad when you defer to liquid prices for an opinion. You will likely be in the smartest company.

If you are interested in the study of when to diverge from consensus, then muster some courage to read Inadequate Equilibria: Where and How Civilizations Get Stuck by Eliezer Yudkowsky. I plan to write a summary blog post of it one day but in the meantime read it for free online (Link).

I don’t follow the news much but keeping up on COVID-19 is one of those times. I subscribed to Taylor Pearson’s Twitter list which includes many smart voices ranging from scientists to investors. (Link)

For a single great follow on COVID-19, check out Balaji Srinivasan. He has been very on point in synthesizing the intelligence he’s gathered from various nodes in the system. He’s trying to steer a multi-disciplinary response to the virus (Link).

The Money Angle

I’ve explained in a past letter how the expensive put skew embedded in SPX option prices reflects 2 realities. First, the average stock in the index will see its volatility increase but more critically the cross-correlation of the basket will increase. Since index option variance is average stock variance times correlation, there is a multiplicative effect of increasing either parameter. The extra rocket fuel comes from the parameters themselves being positively correlated to each other.

In other words, correlation increasing leads to volatility increasing. Since volatility is a practical restraint on position sizing you can think of investment exposures as secretly levered to low correlations. Any battle-tested risk manager will pay close attention to not just net exposures of a hedged book but the gross exposures. The absolute size of the longs and shorts regardless of how offsetting they appear to be. Those gross exposures jump out of the closet to scare you at the worst times. When correlations rip higher.

Check out this bit from Byrne Hobart’s letter this week. First on correlation:

It’s a commonplace observation in finance that when markets go down, all correlations go to one. This makes perfect sense from a Minskian perspective: investors feel safe levering up when they expect economic fundamentals to stay healthy, but the more they lever up, the more any one fundamental change can break the entire system. But it’s also a broader truth: “Black Swans”—extreme events that blow up the assumption of a normal distribution—really only happen if a lot of seemingly-unrelated things are serially correlated. The reason models of the 2016 election underrated Trump was that they underrated the chance that the polling error could go in the same direction in every swing state. The reason credit default swaps on real estate-backed structured products were cheap in 2006 was that most investors didn’t realize that cheap credit had raised the correlation between housing markets, and that asset selection raised the correlation further within each structured product.

Correlation. A cute number between -1 and 1 upon which numbers with many more zeros rest. This can feel abstract if Excel is not your first professional language. When trying to adjust the current virus crisis to compare with historical ones, it’s useful to search for hidden forms of leverage including non-financial types.

Hobart continues:

The outcome of this is that every technology entrepreneur and investor needs to care about the global economy. The trends you’re counting on—free flow of capital, goods, information, and people—are dependent on a set of conditions that might not hold. And they’re correlated. Most useful macro discussions revolve around China, since it’s the axis around which the world economy revolves. But it’s also the lynchpin of the global electronics supply chain. Any plan that presupposes continuous improvements in smartphones and continually cheaper components assumes that China keeps on growing at the same pace, and remains tightly-coupled to the US, Europe, and emerging markets.

Manufacturers are realizing, and consumers are about to realize, that supply chains offer their own sort of leverage, with their own potential for a “Minksy Moment” in which a disruption in one place causes cascading chaos everywhere else. Coronavirus might be a minor speedbump, but it, or something like it, will eventually force a wholesale change in the pace and nature of globalization.

This week concerns of economic slowdown and supply chains as single points of failure are gripping markets. Wall Street is getting way in front of this one, calling for zero economic growth in 2020. Do we just jump to visions of empty planes and restaurants? Morgan Housel likes to remind investors of Napoleon’s definition of military genius: “The man who can do the average thing when everyone else around him is losing his mind.”

From Headlines To Numbers

Slow down to break it down. Consider what variables are being pushed around. Have a model. If your model maps variables to outputs then start turning the knobs to see how sensitive the outcomes are to different scenarios. The point here is not to do numeric Mad-Libs then believe the silly story you wrote. It’s an exercise in thinking. A model turns emotional headlines into dispassionate inputs so you can actually reason about them probabilistically.

My favorite analysis in this vein comes from the philosopher-king of valuation Professor Aswath Damodaran. He starts with his general model then shows at which nodes COVID-19 developments have an impact.

Again the actual numbers aren’t the point. It’s the calming process of seeing how abstract arguments which threaten to shut our minds down into fight-or-flight mode can be safely downshifted into cold digits. Type into cells, hit F9, generate an opinion that can just change with the facts. The full article including Damodaran’s spreadsheet. (Link)

I don’t have a strong corporate finance background. Damodaran’s website is one of the best resources on the web for learning. You can take his NYU course online or just go through his prolific writing. Tying together how growth rates, discount factors, reinvestment, and payout ratios all interconnect before arriving at valuation is actually fun to understand. I found it demystifying to work through this spreadsheet and I recommend it to anyone trying to understand the basics of how to think about share values. (Link)

If you want to see how he adjusts to new facts step through this post from Q42018 (Link)

Climb Higher

Some Favorites of Mine Categorized

Ideas that interact:

- Three Men Make a Tiger + Woozle Effects

- Cumulative advantage + Imposter Syndrome

Math Illusions:

- Anscombe’s Quartet

- Berkson’s Paradox

- The 90-9-1 Rule

- Friendship Paradox

Didn’t know they had a name for that:

- Ringelmann Effect

Effects I’ve re-phrased:

- Boomerang Effect: why persuasion backfires

- McNamara Fallacy: False belief that “everything that counts can be counted and everything that can be counted counts”

- Meat Paradox: Morality when convenient; I think this is one of the perils of abstraction that comes with modernity

- The Middle Ground Fallacy: solutions that work for no one

- Abilene Paradox: A 27th birthday dinner at Rosa Mexicano. Nobody wants this ritual.

Counterintuitive:

- Ludic fallacy: Why fighters who win the gold medal might be precisely those who will be most vulnerable in real life.

- Reflexivity: When cause and effect are the same.

Thwarting and fooling ourselves:

- Actor-Observer Asymmetry

- Moral Luck

- Fluency Heuristic

- Luxury Paradox

Underhanded tactics:

- Poisoning the Well

Last Call

1) If this week’s market turmoil rattled you it’s understandable. You can probably count the number of times the stock market erased 11% in 5 days on one hand. If your horizon is long it’s unlikely to make a difference but it’s a financial hygiene reminder. Meb Faber is one of my favorite market follows. Unlike many famous pundits, he’s a true markets professional. Which means he understands risk, bias, and how to interpret data. He has a gift for distilling the most important financial and investment concepts into understandable frameworks. If you are overwhelmed by how to approach your personal finances, here’s 2 of his articles that will break the problem into approachable steps.

- Recs from his “Office Hours” sessions. Great place to start.(Link)

- He wants you to get on with your life, set up your finances, and automate according to a plan. The plan looks like the USDA Food Pyramid but for investing. The template strikes an approachable balance between simplicity and effectiveness. (Link)

2) Markets have a habit of getting stuck in local regimes. They can trade in ranges but the behavior of the participants can become trained by those ranges and in turn, their behavior reinforces the range. Remember reflexivity. When cause and effect merge in an infinite loop. In trading we often call self-reinforcing regimes “sticky”. This assumption can even be baked right into our models. But we never treat them as a rule of physics. We consider what features of the marketplace must persist for the “stickiness” to persist. This concept exists in many fields. Nicky Case calls “sticky” regimes attractor landscapes. Nicky created a simple game tutorial that allows you to explore the “basin of attraction”, and how “peaks” and “valleys” influence the forces which pull phenomena to their local setpoints. See if you can identify which forces that you may take for granted are guiding behaviors you observe. (Link)

3) I don’t know how I missed Byrne Hobart’s 1-year-old piece Peak California. He articulates and augments many of my own views about California. It’s not uplifting but he doesn’t dismiss the solution. We can stop using tomorrow to subsidize today if we want to save this place. Stay for the footnotes too. (Link)

An excerpt:

Over the long term, California’s future looks like New York excluding New York City, albeit with nicer weather. There will be big companies that slowly decline, the tax base will deplete, and politicians will have to find ways to raise taxes on the remaining citizens while getting them to tolerate the same or diminished levels of government services. Eventually, this will reduce the price of housing, but not in a way that revitalizes startups. Instead, we’ll have a dynamic where a house that used to be 50% too expensive at a million dollars will still be 50% too expensive at $750,000.

4) Musicians Algorithmically Generate Every Possible Melody, Release Them to Public Domain (Link)

5) Mike is a big hockey fan. He sent me this:

Got a feel-good story for you. Both of the Hurricanes goalies went down yesterday in Toronto. Per NHL rules there are 2 guys in the stands at all games that are ready to be an emergency back up for either team in goal. It was a 42-year-old guy who beat cancer twice and had a kidney transplant. On top of that, he drives the zamboni for the minor league team of the Maple Leafs and is a practice goalie for the Leafs. Long story short he gave up 2 goals on 2 shots and then stonewalled the rest of the game. He played more than half the game. He got the win and is the oldest player to win his first start in the NHL and the only emergency goalie to play that long and win. He got a standing ovation from the fans even though he played against the home team and beat them. The governor wants to make him an honorary NC citizen and the mayor of Raleigh has proclaimed this Tuesday “David Ayres Day” as he will be in attendance and honored at the game. Canes have sold over 3000 of his newly minted jerseys already. He gets a royalty and a percentage will go to a kidney charity.

From my actual life

So we need to go to the SF regional office as a family Monday morning to see if we can get one same-day. This is a long-winded way of saying you if I get stranded here you’ll get a Moontower next week after all.

Oh, one more thing. Happy Leap Day Birthday to an unnamed reader who I’m about 29% sure exists. If you exist let me know.

Extra credit this week: solve for how many people receive Moontower. You have enough information.